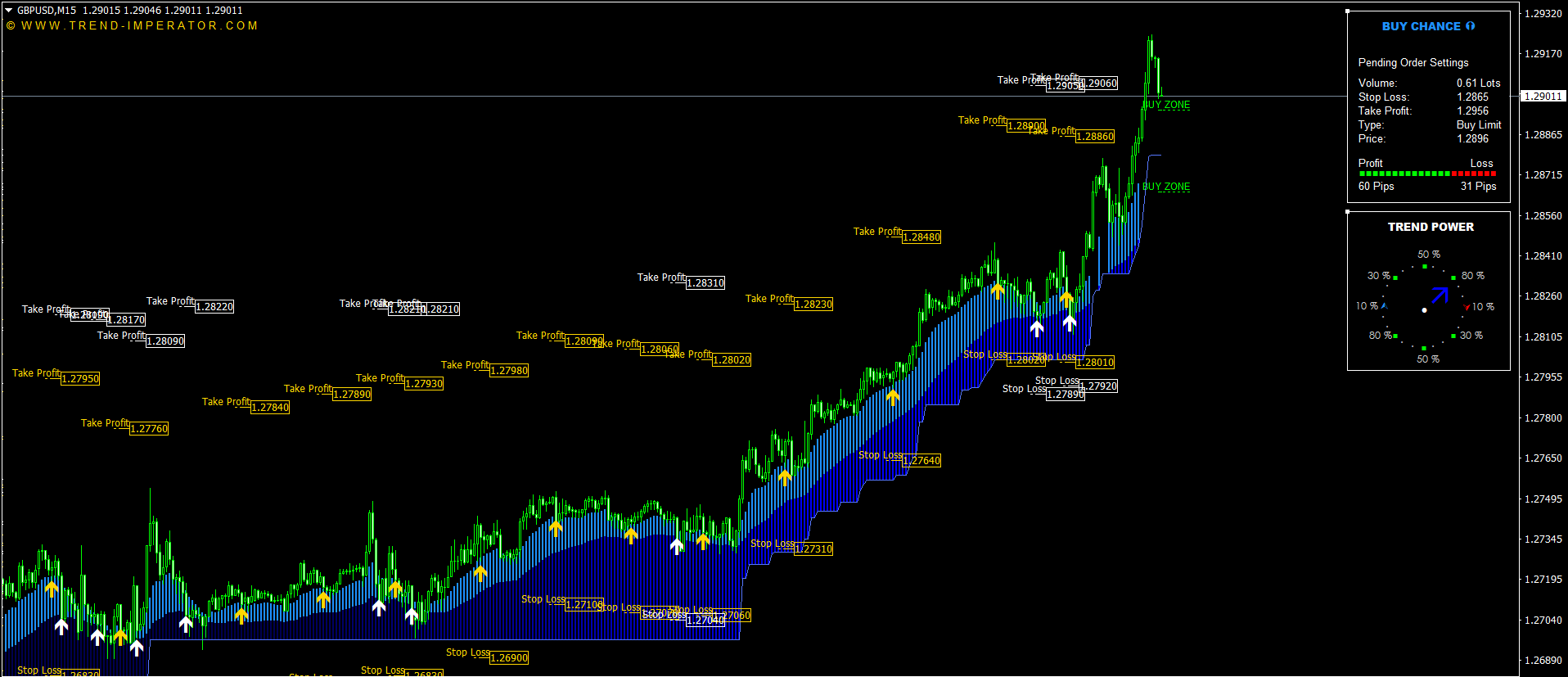

What Is Algorithmic Trading?

Algorithmic trading is an automated trading process. Split-second buy and sell orders are made according to algorithms, sets of computer-programmed directions used to solve problems. Algorithms can be built with high levels of complexity, which is why computer programming is required to write these algorithms and execute them. These automated systems process order executions according to their preprogrammed trading instructions. Algorithms make their decisions by monitoring market variables like timing, price and volume.

Algorithmic trading uses complex formulas, mathematical modeling and human oversight to automate the buy and sell decisions they make. Many algorithms have built-in, high-frequency trading technology to make hundreds or even thousands of executions in just a few seconds. This makes algorithmic trading incredibly efficient for intraday trading, as this speed would be almost impossible to achieve without it.